Automated Demand Response: How the California ADR Program Can Address Changing Grid Needs

Executive Summary

An annual process for the California Joint Investor Owned Utilities (IOUs) consisting of Pacific Gas and Electric Company (PG&E), Southern California Edison (SCE), and San Diego Gas & Electric (SDG&E) was created in Decision 18-11-029, to address ongoing automated demand response (ADR) Program issues which included collecting stakeholder feedback on the issues and resolutions. Through the 2019 ADR issues process, all pending issues were addressed except an approach to calculating control incentives in the ADR Program remained open. The IOUs decided this research project was needed to be adequately equipped to resolve the issue. A Research Team (Team) including Energy Solutions and Lawrence Berkeley National Lab (LBNL) was engaged to develop an updated approach to ADR incentives for nonresidential customers and/or third parties through literature review and data analysis. The Team developed a research plan, based on IOU feedback and an ADR stakeholder workshop, that framed the pertinent research questions in four categories: market related, historical, technical, and exploratory. Results of the studies in each category and the updated ADR incentive structure are presented in this report.

The Historical Study included analysis of IOU ADR Program application data over the last 10 years to determine recent trends that highlight successful program aspects and areas in the most need of updates. The analysis found that the DR controls (including the communicating virtual end node (VEN) device) consistently make up the largest portion of costs across all project applications, comprising roughly 50 to 60 percent of total project costs (not just eligible ADR incentive portion). Labor costs, which consist of programming, installation and commissioning, project management and engineering vary more widely across the sectors analyzed. The average across all applications analyzed was $377/ kW though the range varied greatly from less than $100/kW to more than $2,000/kW. Appropriate data to evaluate free ridership across ADR programs was not available. That data show that for 76 percent of the incentivized ADR MW from the last 6-10 years, the incentive payment was made to the vendor. Noting that program policies starting in 2017 have eliminated the option of vendor payment for two IOUs and volume of applications have decreased. In general, customers that received an ADR incentive within the last five years achieve a higher level of performance than customers that were paid an incentive more than five years ago. Since 2015, enrollment has trended away from large industrial customers towards a higher prevalence of retail and agricultural customers These customers are a good fit for the future ADR Program, due to low variability of retail sector performance, widespread availability of affordable ADR control technologies for retail, expanded control technology eligibility for agricultural customers and the prevalence of these types of sites in California. Historically, participation in paid ADR MW peaked in 2012, after which applications decreased substantially. Research indicated the trend was due to changes in incentive structure. Research also showed that 84 percent of accounts were enrolled in a DR program for at least three years after incentive payment. The IOUs have found marketing successes and best practices using trade ally networks and vendor engagement.

The Technical Study conducted reviewed technology DR potential analysis, ADR technology studies, measurement evaluations, and ADR Program data analysis. The research found that the development of the new incentive design should start with specific technologies capable of Shift services which hold the greatest DR value to California but in the end the new structure is open to all ADR capable technologies. There was limited data available from California statewide load impact evaluation reports to compare DR event performance of ADR customers compared to manual DR participants. While there is a limited number of research reports documenting cloud technology operation, it was found that the majority of the nationwide commercial technology incentive programs allowed cloud technologies to participate. The results from one ADR Program found that the cloud technologies performance and participation consistency was similar to on-site technologies for a slightly lower cost.

Explore Questions framed strategic issues and sought to capture insights from the research studies. With DR opportunities in nearly all non-residential sectors, the research did not provide evidence to limit the incentives to any customer segment. In California, DR has been the focus of legislation and the recent CEC Load Management Rulemaking with a focus on the future trend of developing real-time tariffs. The main hurdles to ADR Program adoption are application process, incentive structure, incentive evaluation and DR program design. Midstream models have advantages that have been piloted and studied with HVAC equipment but the effectiveness of such a program structure for other technologies, is currently untested in the literature. Researchers found that the current 60/40 incentive split between installation and performance is a major barrier to participation as it does not align with business models and adds uncertainty to financial planning. The ADR Program would instead benefit from a redesign of this incentive structure. The ADR Program objectives overall align with research findings, with the opportunity to update the Objective to account for future trends in the value of dynamic/RTP and bi-directional load change.

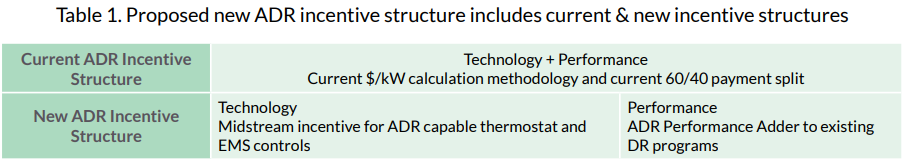

In developing the proposed ADR Incentive Structure the research highlighted that the current ADR incentive attempts to increase adoption of all types of ADR technologies and increase participation in all DR programs, which is a broad scope. Therefore, the new incentive structure contains two aspects, outlined in Table 1: 1) midstream incentive

for ADR-capable thermostat and energy management system (EMS) controls and 2) ADR Performance Adder to existing DR programs. The research confirmed that the most effective way to drive adoption of thermostats and EMS is through a midstream incentive. Combined with the large potential value of HVAC measures in the future of DR and the maturity of the technology, this enabled the Research Team to determine a dollar value-per-device as part of this midstream incentive structure. The ADR Performance Adder will support all technologies and focuses on a streamlined participation delivery channel layering the incentive on top of existing DR program payment structures to motivate automated participation in DR programs while still reducing the ADR technology cost. For example, the proposed ADR Performance Adder could layer on top of the Capacity Bidding Program (CBP) and approximately double the current capacity payment for those customers participating with ADR technology for three-year time window.

To create a bridge period for the market to transition to the new structure, we recommend the current incentive structure remain in place but with a fixed budget, to motivate participants towards the new structure. These new incentives aim to increase adoption of ADR technologies now, that will enable customers to be successful in the future as RTP becomes more prevalent. It also allows innovation in the DR industry to harness the ADR Performance Adder via current and new business models.